Lifelong Hearing Loss

At the age of nine years old, I was diagnosed with progressive sensorineural hearing loss. At that time, I already had a 60% loss in the high tones. No one knew I was deaf because I had adapted and learned to lipread. I suspect most people I encounter these days don’t realize how deaf I am. I have had hearing examinations where the audiologist thought something was wrong with their equipment because I am so deaf I don’t hear most of the tones. My speech comprehension goes down about 50% when the audiologist covers their face with a piece of paper. I was recently tested and my loss has progressed from the “Moderate to Severe” category to “Severe to Profound”. Without hearing aids the world is a very quiet place.

Unprepared to be Uninsured

For the whole of my adult life, healthcare and insurance were not things I worried about. My first husband was in the military, so on those rare occasions I needed a doctor, I saw whoever was on shift at the base clinic. When I was pregnant with both my children, an Ob/Gyn was assigned to me and then I saw whoever was on shift when it was time to give birth at a military hospital. When I went to work for a city government, I had health insurance and doctors were assigned to me sort of magically. For much of the time I had health insurance, I didn’t even make the deductible. I was completely ill-prepared to join the legions of the uninsured in 2010 when I had to take an early retirement from my civil service job.

Phone Impaired in the Age of Smart Phones

I was last able to use the telephone on a limited basis in 2009. Even though I had a special amplified handset on my work phone, I sometimes would get a call and be unable to understand anything the caller was saying. I had to hand the phone to a co-worker when that happened.

Now that I don’t have an amplified land line, I cannot use the phone at all. What calls get made, my husband has to make or take them for me. He has auditory processing disorder and is likely high functioning autistic as well as ADHD. So phone calls take a lot of energy on his part and I don’t ask him to make them unless it is absolutely necessary.

One of the things I think many people may not be aware of is that many, if not most, healthcare practices do not accept uninsured patients. This is especially true of specialist like GI and endocrinologists. I don’t blame them, I cannot pay medical bills unless they are given to me in a manner that I can plan for and afford while still paying upfront for ongoing health care, medications, and supplements. Not being able to use the telephone to call multiple practices to inquire about their patient acceptance practices and to get cost information upfront makes it nearly impossible for me to get services I need even if I have funds to pay for them.

The High Cost of Not Knowing

After retiring early without health insurance, I managed to get by for three years without any healthcare. When I started having chronic diarrhea, I looked around online to find help that I could afford. That information was not obtainable without a phone, so I wound up in the local university hospital ER with a blood pressure of 240/130. We owed no one when we walked in the hospital doors and now we had debt more than a small house would have cost. I remember lying in bed in a haze and crying because I felt I would never again own a home of my own.

Ironically, the event that I believe triggered my hypertension was related to an unscheduled “invasion” of our duplex by appraisers. One of the reasons I need a home of my own is that I don’t feel entirely safe in a rented home. It is a subjective thing and I have been at loss to explain it until I started learning about autism.

During the four day hospital stay, I filled out an application for financial assistance, but since I still had money in a retirement savings account, my application was denied. I did not feel I should take the money out of that account because I was saving to buy new hearing aids. The ones I was wearing were over 10 years old.

I considered trying to pay the hospital $20 or $30 dollars a month to preserve my tattered credit rating, but I received about a dozen bills, none I could afford. One was for $47,000 (that was already discounted 60%) from the hospital. Several were for $2,000-to 3,000 and numerous in the hundreds from various entities like labs, catering, and doctors. There were even separate bills for the emergency room. There was no way I could pay all of them even at $10 a month. We were living payday to payday with little remaining. Since I could not pay all of them, I did not pay any of them. I was used to paying my bills on time and so consciously deciding not to pay these bills caused me a lot of distress. I still had undiagnosed and complicated health problems that needed ongoing care. I had no idea how I was going to pay for that.

Hostage to the System

I was referred to a local health clinic and I paid for that out of my income tax refund, which I had decided to park in a savings account to pay each years’ ongoing medical expenses. When I was referred to a rural GI practice, my husband’s mother gave us several thousand dollars to help pay for it. This experience was another nightmare. The rural GI was treating thousands of low-income patients and he had, at most, 15 minutes of time with us. He spent most of that time entering data into a computer. This was a problem for me because I need people to face me in order to be able to lipread. I explained that repeatedly, but he either forgot or ignored my request.

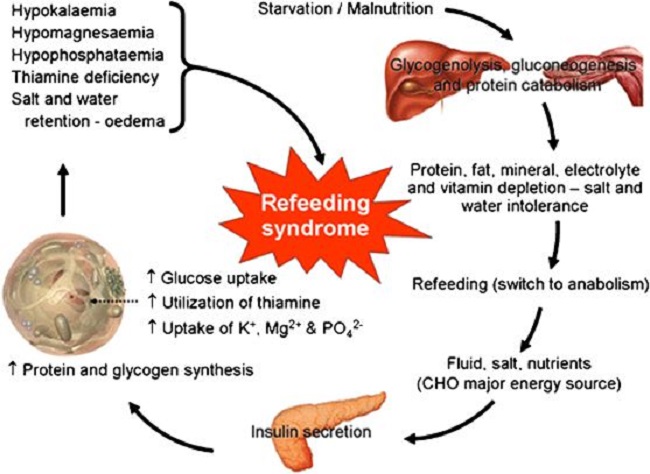

I was having ongoing diarrhea, digestive issues, and malnutrition when I was referred to the GI. I did not feel it was safe to protest or be overly assertive with this doctor, as I desperately needed his services. His lack of accommodation for my deafness was only part of what made this experience so upsetting. He seemed to have no understanding or concern for our financial issues. Even though we explained our financial situation, he ordered a litany of expensive tests. I could not get anyone at the clinic to tell me how much things would cost upfront. Even his office visits were a problem. I asked about cost and explained I was uninsured at the time of the first office visit. I paid the $179 they requested up front, but then they would send me additional bills for $79 with no explanation. The total of all the tests including endoscopy and colonoscopy, CT scan, etc. was somewhere around $8,000-9,000. I think we paid 4 or 5 thousand up front from money my mother-in-law gave us. Again I didn’t get one billing entity, but a 1/2 dozen or so different bills. So that was yet another hit to my already miserable credit rating.

I continued to suffer digestive issues even on the prescription enzymes and PPI. Since the doctor declined to address several of my health concerns that he didn’t feel were GI related, I was disinclined to go see him again. It was only when we finally got two incomes that we were able to afford an allergist. I was diagnosed with 44 food allergies as well as multiple environmental ones. The allergies were the cause of the digestive problems that the GI refused to evaluate. That was another three years of my life needlessly lost to digestion related malnutrition.

New Type of Primary Care

I recently changed from the local corporate clinic to a new type of family practice two hours away. The family practice seemed like a good deal as they had lower costs for lab work and a monthly fee with $20 an office visit charge. They also had a patient portal which seemed ideal for me since I could write about my problems instead of trying to relay them via my husband over the phone. After two visits at $180 a piece, I had problems because they didn’t seem to want to hear about any of the problems other than the type 2 diabetes. When I managed to get them to understand the full range of my health problems, they unceremoniously dumped me via email. They referred me to a nutritionist who strung me along two weeks before declining to take me as a patient because I could not do consultations on the cell phone.

This dumping echoed a lot of childhood experiences of rejection so it was traumatic enough that it made me cry. It has been increasingly hard for me to put my trust in healthcare professionals since the death of my second husband to colon cancer. They were not the cause of his death but there was a lot of needless suffering along the way. This opened my eyes to problems in our healthcare system I was previously unaware of.

Fairly frequently in the past eight years, I have felt a sort of despair that is like being trapped in an emergency situation with no way to call out for help. Some of this stems from a lifetime trauma coping strategy of submission and some of it is due to poor communications skills on my part. I can never know how well I will be able to articulate the thoughts in my head. They seem so clear to me but somehow come out confused and garbled when I am stressed. I have to do a lot of meditation and exercise to calm down HPA activations just prior to a healthcare visits. I arrive at my appointments with as much written down as I can manage because stress causes me to lose even more communications abilities.

Direct Primary Care

I finally had a bit of luck when I found a Doctor of Internal Medicine who has a Direct Primary Care practice. I had almost disabling anxiety in the weeks up to my first visit because I was afraid if I told her too much about my problems she might refuse to take me as a patient. Fortunately, she was honest, blunt, and straightforward in a way that alleviated my anxiety. I focused on my official diagnosis and getting medications refilled on our first visit. On the second visit, I wanted to focus on the undiagnosed problems. Thanks to Chandler Marrs for editing and publishing my story here on Hormones Matter, I feel I have been heard and understood. As a result, I now have referrals to an endocrinologist, a GI, and a contact to get evaluated for High Functioning Autism (HFA).

We Need Your Help

More people than ever are reading Hormones Matter, a testament to the need for independent voices in health and medicine. We are not funded and accept limited advertising. Unlike many health sites, we don’t force you to purchase a subscription. We believe health information should be open to all. If you read Hormones Matter, like it, please help support it. Contribute now.

Yes, I would like to support Hormones Matter.

Share Your Story

If you have a complicated health story to share, send us a note.